What is Gamma in Options Trading and How Is It Applied?

This is the TradingFlow Team, and this article will focus on options or equities, guiding you through the rationale behind compelling trades and demonstrating how to effectively utilize TradingFlow tools.

This article will explore the concept of Gamma in options trading, detailing its significance and practical applications within the context of managing options portfolios.

(Source: Unsplash)

Understanding Gamma:

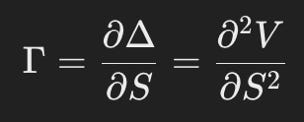

Gamma measures the rate of change of delta (Δ) with respect to changes in the price of the underlying asset. Delta represents the sensitivity of the option's price to changes in the price of the underlying asset, S is the price of the underlying asset, and V is the value of the option.

Gamma is close to 0 implies either the relationship between the price of the option and the price of the underlying asset is linear or the option position has no convexity, i.e., the position holding is far OTM or ITM. Conversely, gamma is highest when option is ATM according to the fastest change of delta at option ATM price, even a small change in underlying price can cause a significant change in delta.

Understanding 0DTE:

Most investors who play around with 0DTE options usually buy OTM or ATM options to bet for the instrinsic value with lower premium. For institutional investors and market makers, understanding 0DTE gamma is crucial for managing risk. They need to adjust their hedging strategies frequently to maintain a delta-neutral position and manage exposure to price changes in the underlying asset.

For example, this is the Intel call option expiring on July 12th 2024. The stock price is 34.6, and the strike price is 35 with 2 more days of expiry. Option price equals intrinsic value plus time value. Since this is an OTM call option, the option price has intrinsic value of 0 left only with time value of 0.38. Suppose Intel stock price rises from 34.6 to 35.6, then this OTM call option becomes ITM, thus the option price becomes 0.92 after calculation. With $1 increase, this 0DTE call option rises 1.5x.

Using the same example by looking at the chart above, we can see this OTM call option on Intel has chance to be ITM, but this high return comes along with high risk. Because 0DTE options have a trading life of only one day, they may lose most of their value within a trading session due to time decay—a concept known as theta. Then there is gamma, which tracks changes in the delta of an option, which makes it highly attuned to the price of the underlying asset. So, in a single trading session, even a minor change in the price of the underlying asset of a 0DTE option can greatly affect the value of the option before it expires.

Understanding Gamma at 0DTE:

Besides moneyness, gamma is also affected by time to expiration. Investors tend to look at 0DTE gamma for several reasons, primarily due to the high sensitivity and potential for significant price movements in the underlying asset as the options approach expiration. As 0DTE approaches, if an option is OTM, it has smaller chance than longer expiration date to be ITM. Thus the delta won’t change that much, leading to a more stable gamma. Same logic applies for ITM options. For ATM options, as expiration nears, gamma increases and the bell-curve-shaped chart of gamma becomes more peaked since it is no surprise that those options which are at the money and with very little time to expiration are the most instable, with highest gamma.

High Sensitivity to Price Movements:

Increased Gamma: As options near expiration, their gamma increases significantly. This means that the delta of the options changes rapidly with small movements in the underlying asset's price. This heightened sensitivity can lead to substantial gains or losses in a very short period (QuantInfo).

Potential for Significant Profit:

Leverage: 0DTE options provide traders with the opportunity to use leverage effectively. With high gamma, small movements in the underlying asset can lead to large percentage changes in the option's value, offering the potential for substantial profits from small investments (SteadyOptions).

Market Directional Bets:

Short-Term Trading: Traders use 0DTE options to make short-term bets on the direction of the underlying asset's price. Given the high gamma, even minor price movements can significantly impact the option's value, making them an attractive tool for day traders and those looking to capitalize on short-term market movements (Morpher).

Risk Management and Hedging:

Dynamic Hedging: For institutional investors and market makers, understanding 0DTE gamma is crucial for managing risk. They need to adjust their hedging strategies frequently to maintain a delta-neutral position and manage exposure to price changes in the underlying asset (The Trading Analyst).

Market Sentiment Indicators:

Volatility Indicators: The activity in 0DTE options can also serve as a gauge of market sentiment and expected volatility. High trading volumes and significant gamma exposure in these options can indicate that investors are expecting major price movements or heightened volatility (QuantInfo).

The focus on 0DTE gamma stems from its ability to magnify the effects of price movements in the underlying asset as expiration approaches. This characteristic makes 0DTE options a powerful tool for both speculative trading and risk management, providing opportunities for significant profit while also requiring careful attention to manage the associated risks.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe