US Stock Market "Black Wednesday": What's Next?

This is the TradingFlow Team, and this article will focus on options or equities, guiding you through the rationale behind compelling trades and demonstrating how to effectively utilize TradingFlow tools.

This article will review the recent sharp decline in the U.S. stock market, analyze the reasons behind it, and take a look at what the market should focus on moving forward.

NASDAQ Plummets 3%: Tech Giants' Earnings Misses Spark Market Turmoil

According to TradingFlow data, the NASDAQ's net DEX was negative from July 16 to July 23, indicating a bearish signal. The NASDAQ 100 index plummeted 3.6%, wiping out $1 trillion in market value, marking its worst performance since October 2022, driven by disappointing earnings from tech giants TSLA and GOOG. Leading AI sector companies like NVIDIA, Broadcom, and Arm also saw significant declines. The "Big Seven" index of U.S. tech giants fell 5.9%, breaking below the 50-day moving average for the first time since May. Mapsignals Chief Investment Strategist Alec Young noted that investors are realizing the returns on AI investments will take time, which will affect the short-term growth of these giants.

Poor earnings reports from Tesla and Alphabet (Google) have caused investors to question whether the 2024 rally driven by large tech companies and artificial intelligence is sustainable. Tesla's stock dropped 12% due to declining electric vehicle sales. Although Alphabet's earnings had some positive aspects, the market ultimately interpreted them as negative, leading to a sharp drop in its stock price. In the upcoming week, earnings reports from META, MSFT, AMZN, and AAPL will be released, with the market expecting at least two of these companies to miss expectations, potentially exacerbating the decline in U.S. stocks. As the market plummeted, the Chicago Board Options Exchange Volatility Index (VIX), also known as Wall Street's fear gauge, rose to 18.46, its highest level since late April. TradingFlow data indicated that VIX options turnover on Tuesday was nearly double the usual amount.

IBM's second-quarter earnings exceeded expectations, attributing over $2 billion in orders to generative AI, but the market response was muted. As shown in the chart, IBM's net GEX was positive. SK Hynix also reported more than doubling its second-quarter revenue, indicating that the global surge in AI hardware spending may continue. Microsoft introduced gen-AI in Bing search, similar to Google's AI Overviews, while Nvidia designed a new chip specifically for Chinese servers to comply with U.S. regulations.

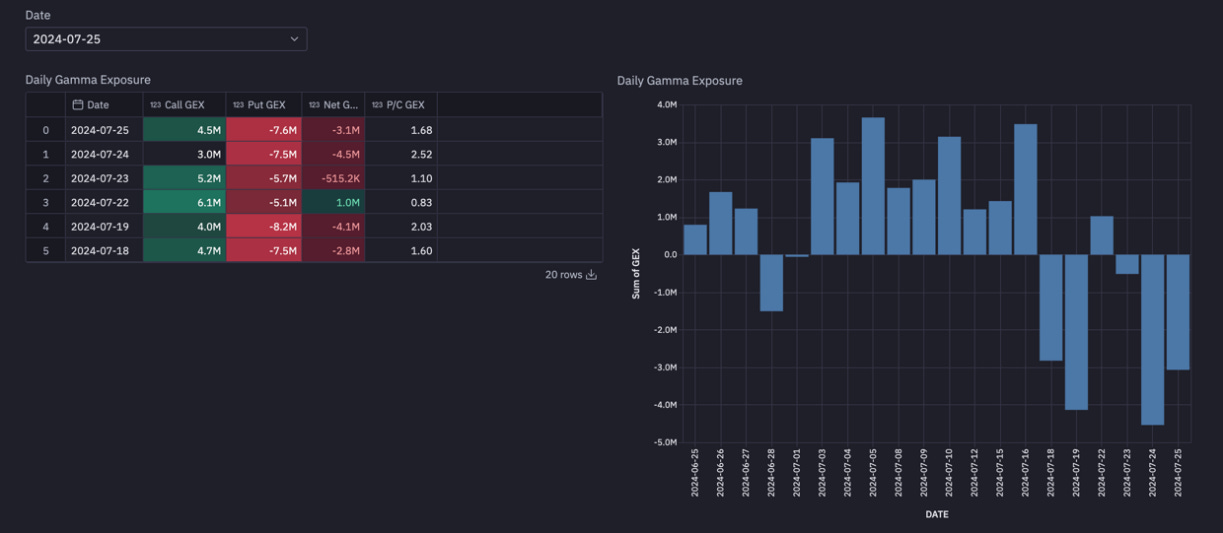

The market is concerned about the investment prospects of AI technology, fearing that the AI-driven bubble may burst. According to TradingFlow SPY's Gamma Exposure data, the net GEX was negative over the past week, meaning market makers would sell as prices rise and buy as prices fall, increasing market volatility. Although IBM and SK Hynix's earnings showed growth in generative AI and high-bandwidth storage chips, they did not alleviate the market's pessimism towards tech stocks.

Goldman Sachs analysis indicates that the S&P 500 and NASDAQ 100 indices have breached the commodity trading advisor (CTA) sell signal thresholds. If the market continues to decline, trend-following traders might withdraw up to $219 billion from global stock markets, including $67.1 billion from the U.S. market.

The Federal Reserve's interest rate cut expectations also add to market uncertainty. UBS senior U.S. economist Brian Rose stated that the likelihood of a Fed rate cut in September is "close to 100%." However, the market fears that an early rate cut might spark economic recession and earnings decline speculation, leading to a recession trade and further drops in U.S. stocks.

Overall, disappointing earnings from tech giants and concerns over an AI bubble burst have triggered a sharp decline in the NASDAQ. Investors need to monitor the upcoming earnings reports from the four major tech giants and the Fed's rate cut moves to assess the market's future direction.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe