Mid-August Market Review After U.S. Stock Market Plunged

This is the TradingFlow Team, and this article will focus on options or equities, guiding you through the rationale behind compelling trades and demonstrating how to effectively utilize TradingFlow tools.

Market Summary and Outlook

At the beginning of the August, the U.S. stock market experienced extreme volatility, driven by multiple factors including rumors of Warren Buffett reducing his Apple holdings, changes in Japanese yen carry trades, and mixed economic signals. The week saw wild swings, with major indices like the Nasdaq fluctuating dramatically.

Monday (5th August) saw the Nasdaq drop 6.2% at the open, only to recover some losses by the end of the day. Despite a strong rebound mid-week, investor sentiment remains cautious due to uncertainty surrounding the Fed’s interest rate decisions and upcoming economic data releases.

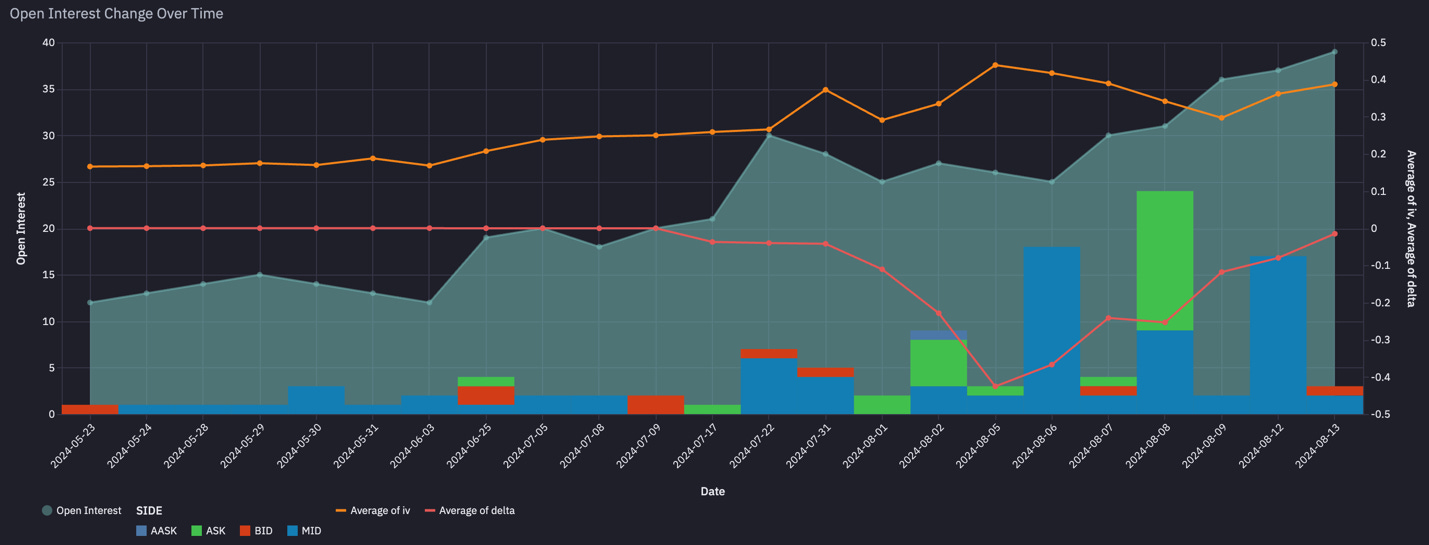

On Tuesday, after the Bank of Japan hinted at a more supportive approach to monetary policy, the market saw a broad rebound. The Nikkei index, which had hit the lower circuit breaker in the previous trading day, surged and hit the upper circuit breaker. This also led to a strong rally in U.S. stocks, with intraday gains of up to 2.5%. From Trading Flow data, for NDX 240816P176000, most transactions were completed on the ask side, indicating a bearish signal, which Nasdaq rebounded from August 5th’s 17,895.16 to August 6th 18,077.92. However, the option OI increased on Tuesday, indicating the situation might not be as simple. In the last hour of trading, the U.S. stock market experienced a dramatic plunge, dropping 1.5%, catching the bulls off guard.

On Wednesday, the Federal Reserve issued a statement suggesting they were likely to maintain a stricter approach and wouldn't cut interest rates soon. The market rallied again, with the index surging 2% at the open. But just when we thought the market had turned bullish, the index once again experienced a sharp drop after a strong open, this time even more than on Tuesday. By the end of the day, the index closed down 1%, with an intraday drop of 3%. The average volatility of the seven major tech giants exceeded 5%.

On Thursday, unemployment claims data were released, and because the figures were below expectations, the market interpreted this as a sign that the economy had not yet entered a recession. The index saw another violent rebound, closing up 2.87%, with intraday volatility once again reaching 3%. In other words, in the first four trading days of the week, daily volatility exceeded 3%, which led to increased caution across the board on Friday.

On Friday, there wasn’t much happening—it was primarily a day of crushing options implied volatility. The three major indices collectively closed higher, ending the most turbulent week since the beginning of the year. However, looking at the week's overall performance, it can be said that the bulls and bears were temporarily at a stalemate. The Dow Jones fell 0.6% over the week, the S&P 500 dropped 0.04%, and the Nasdaq lost 0.18%. Neither side made significant gains, but options buyers were completely wiped out.

Market Volatility and Strategic Considerations

The market’s current volatility can be attributed to reduced liquidity, with significant sell-offs from major investors like Buffett and declining market liquidity. The VIX index, which measures market volatility, reached levels not seen since the 2020 pandemic peak, indicating heightened uncertainty. While some analysts, like those at Goldman Sachs, believe the market has bottomed out and expect a general uptrend, others, like those at JPMorgan, remain cautious due to potential risks.

(Source: Unsplash)

Trading Strategy

Given the market’s unpredictable nature, a cautious approach is recommended. The potential for further volatility is high, especially with the upcoming data releases. A strategy of buying on dips, particularly in robust companies like META, NVDA, and MSFT, is advised, while being wary of companies facing uncertainties like AAPL, TSLA, and GOOG. The market may see a significant downturn this week, but this could present a buying opportunity, especially towards the end of the week as the outlook stabilizes.

In summary, while the market may not have reached a definitive bottom, it’s approaching a period where strategic buying opportunities could arise, especially if key support levels hold.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe