How to Track Options Opening and Closing Positions?

This is the TradingFlow Team, and in the previous post Unlocking Insights: How to Spot Different Types of Options Activity with TradingFlow, our Team introduced types of options trading and provided cases of determining specific types using the TradingFlow tool.

In this article, let's take a look at recent unusual options activities in chip manufacturer Marvell Technology ($MRVL) to understand how to track options trading opening and closing.

In recent market conditions, with the reduced likelihood of Fed rate cuts this year and a surge in March non-farm payrolls, volatility has increased in the tech sector. Within the chip sector, the options activity of Marvell Technology ($MRVL) has caught the attention of the Wall Street Quantitative Team.

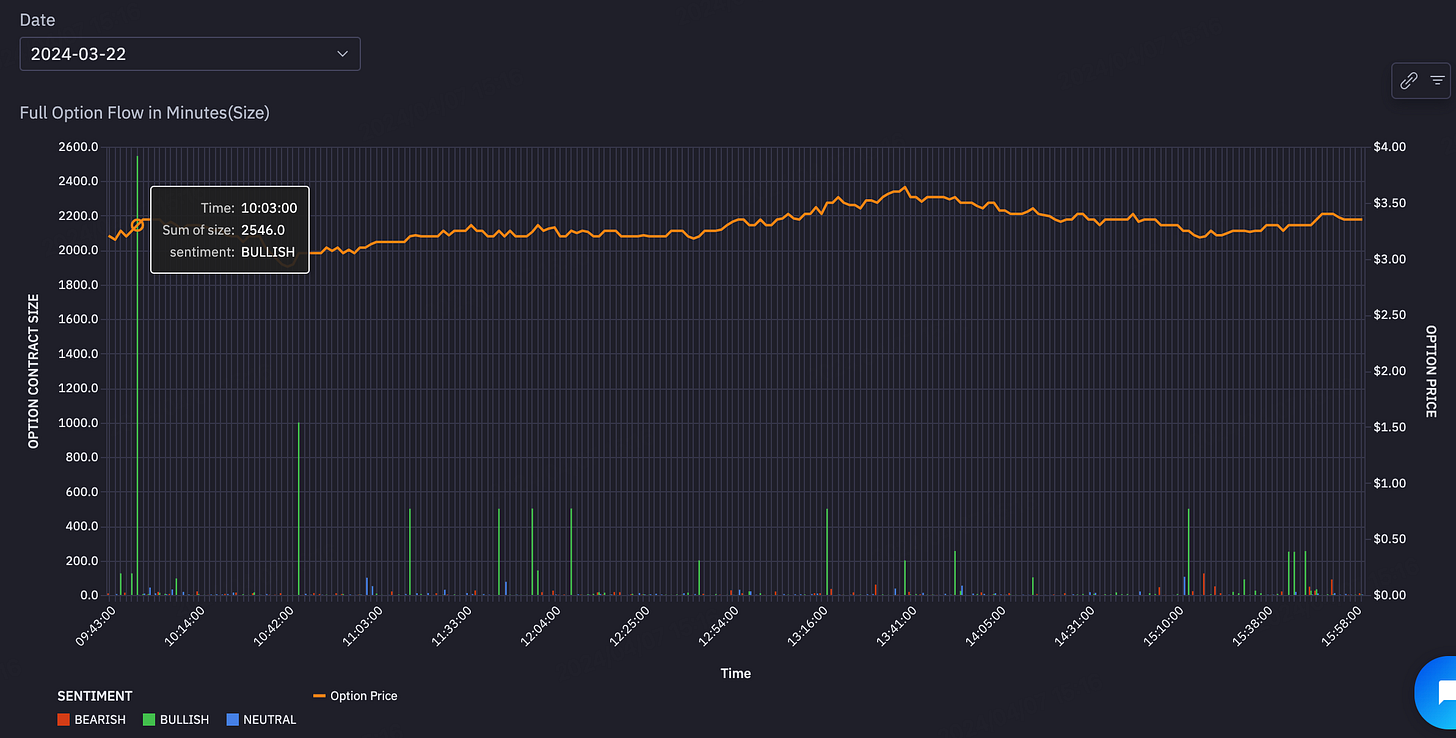

On 22nd March, there was an unusual trading volume for $MRVL call options with a strike price of $70 and an expiration date of 17th May, exceeding 2500 contracts shortly after the market opened. Throughout the remaining trading hours, there continued to be scattered trades related to this call option.

Could these trades be "opening positions"? Since most of the contract volumes involved in the above trades are smaller than the previous day's open interest (2241), determining whether they are "opening positions" requires more data.

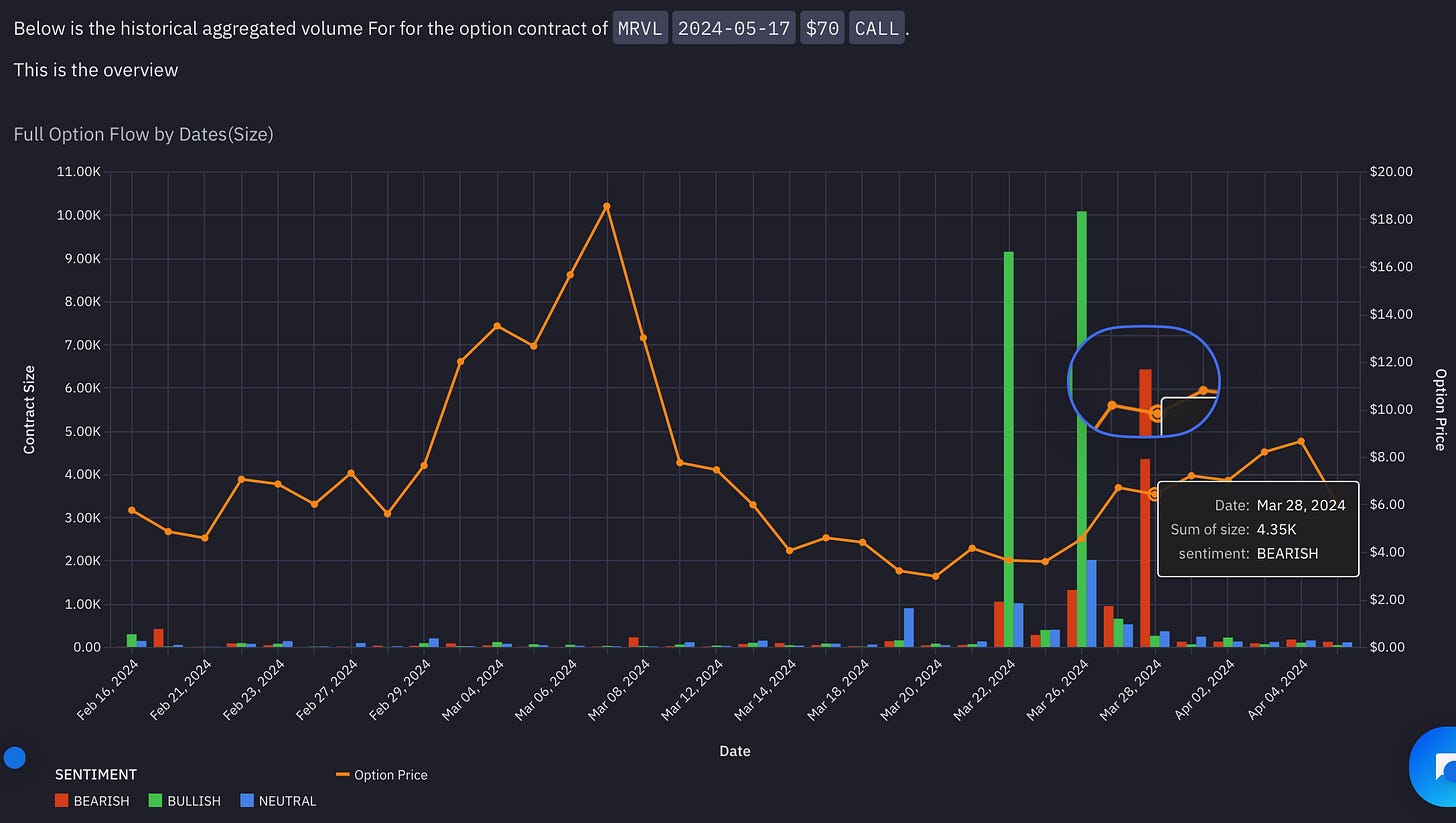

The open interest (oi) data obtained on the next trading day, 25th March, showed that 9577 contracts from 22nd March were carried over to open interest. Considering the order sizes during trading hours on 22nd March, it is highly likely that these trades were all new openings.

From the Avg price column in the chart above, on 22nd March, the average transaction price for the relevant trades was $3.29, and the contract average price dropped on the next trading day. Judging from the open interest (oi) changes, traders did not close their positions but endured the decline and continued to hold the contracts.

On 26th March, $MRVL's stock price rebounded by over 3%, and the aforementioned contract trades began to profit after offsetting the decline. It is also noteworthy that the call options saw an almost doubled increase in oi, indicating that the traders may have added to their positions.

On the TradingFlow platform, we can access the intraday data for 26th March (see the chart below). Half an hour after the market opened that day, a large number of orders flooded in, and the total volume continued to rise throughout the rest of the day. Judging from the addition of 10839 oi data on that day, it can be determined that the related trading orders were also new openings.

On the next trading day (27th March), the average contract price reached $6.01, indicating that traders who continued to hold the contracts likely obtained substantial returns.

On 28th March, the oi decreased by 4026 contracts. At the same time, intraday data showed that 4349 call option contracts were traded with a bearish sentiment, indicating that the traders mentioned earlier may have closed a portion of their positions. As of 5th April, the oi continued to remain at 17000+. It appears that the traders still hold a majority of the contracts, and compared to their initial entry prices, they have likely made substantial profits!

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now. Promotion 30% off with promo code: 30PCTOFF ends July 15th, 2024.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

As one of the most cost-effective investment platforms currently on the market, moomoo is definitely a go-for for those who would like to fund their option trading. Moomoo not only provides $0 commission fees and $0 US stock option contract fees. Index options are subject to a $0.5 contract fee per contract. Other fees may apply. Until March 31(th), new users have chance to earn up to 8.1% APY on idle cash and 15 free stocks. By enrolling in the Cash Sweep Program, you can enjoy 5.1% basic APY and an extra 3% APY for 3 months once the Rate Booster coupon is activated. With no additional subscription fees required, moomoo provides free real-time options quotes, no longer delayed by 15 minutes. Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus!

Disclaimer: The full article is for information sharing only and does not provide any investment advice. Please be careful with the information provided in the article. The data interpretation in the article may be biased or deficient, so please make your own independent analysis and judgment. If you have any questions about the content of the article, please contact the support team. Options trading is risky and not appropriate for everyone. Read the Options Disclosure Document (j.us.moomoo.com/00xBBz) before trading. Options are complex and you may quickly lose the entire investment. Supporting docs for any claims will be furnished upon request. $0 commission trading is available only to U.S. residents trading in the U.S. markets through Moomoo Financial Inc. Other fees may apply. For more information, visit moomoo.com/us/pricing The Cash Sweep Program is a feature of the brokerage account and should not be viewed as a long-term investment or savings option. The APY might change at any time. Neither Moomoo Financial Inc. nor any of its affiliates are banks. Enrollment in the Cash Sweep Program is required to earn interest on uninvested cash. Promo 8.1% APY (as of 01/11/24): Base Rate is 5.1% APY, plus a 3% temporary boost is available for 3 months on up to $20K in the Program once coupon is activated. Actual APY earned may differ as the base rate may change. The Deposit Welcome Bonus is only available to clients who have never made a deposit. The free stocks received will vary. After receiving the free stocks, you will need to maintain your average assets based on the deposit requirements for 60 days to unlock the stocks. Other terms and conditions apply. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided by the influencer are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any trading strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results.