How to Track Momentum Traders?

This is the TradingFlow Team, and this article will focus on options or equities, guiding you through the rationale behind compelling trades and demonstrating how to effectively utilize TradingFlow tools.

Recently, with the majority of giant tech stocks undergoing a pullback, the overall performance of the US stock market has been lackluster. However, there are still traders seizing intraday opportunities.

In this edition, we will share recent intraday trading activities regarding Apple Inc. ($AAPL), where traders capitalized on the stock's upward trend, reaping substantial profits within the same day.

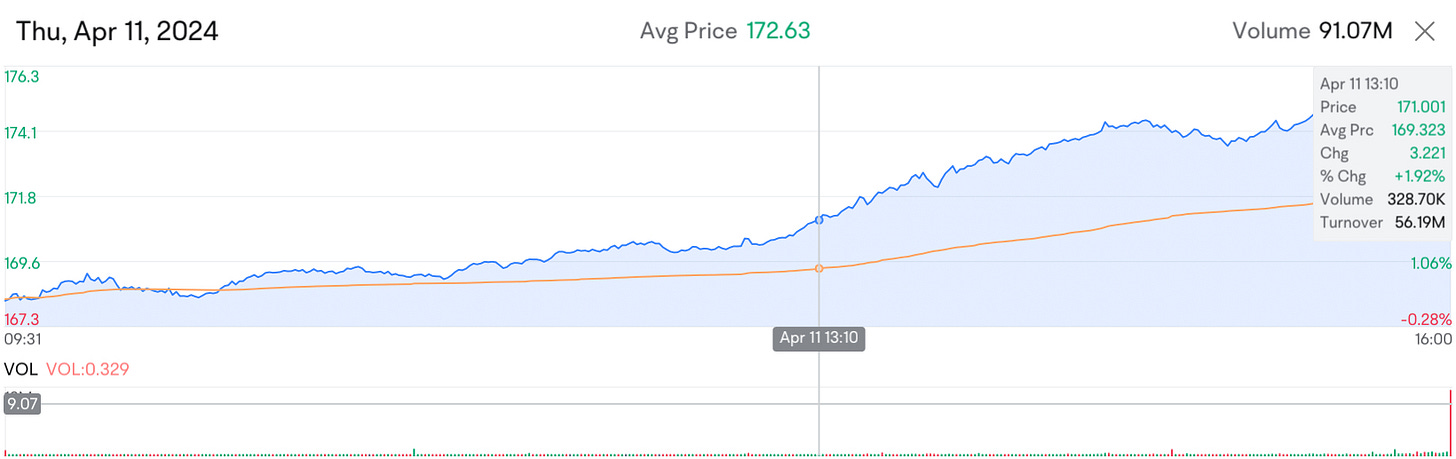

Options activities first appeared during the midday of 11th April, when a significant influx of buy orders for 3rd May expiring call options with a strike price of $185 flooded in after Apple's stock price confirmed a breakthrough above the $169 resistance level.

This trade involved approximately 1000 contracts, with an average execution price of around $0.63 per contract. As seen in the chart above, following this transaction, there were subsequent buy orders for 300 and 200 contracts. Meanwhile, the price of Apple stock continued to rise.

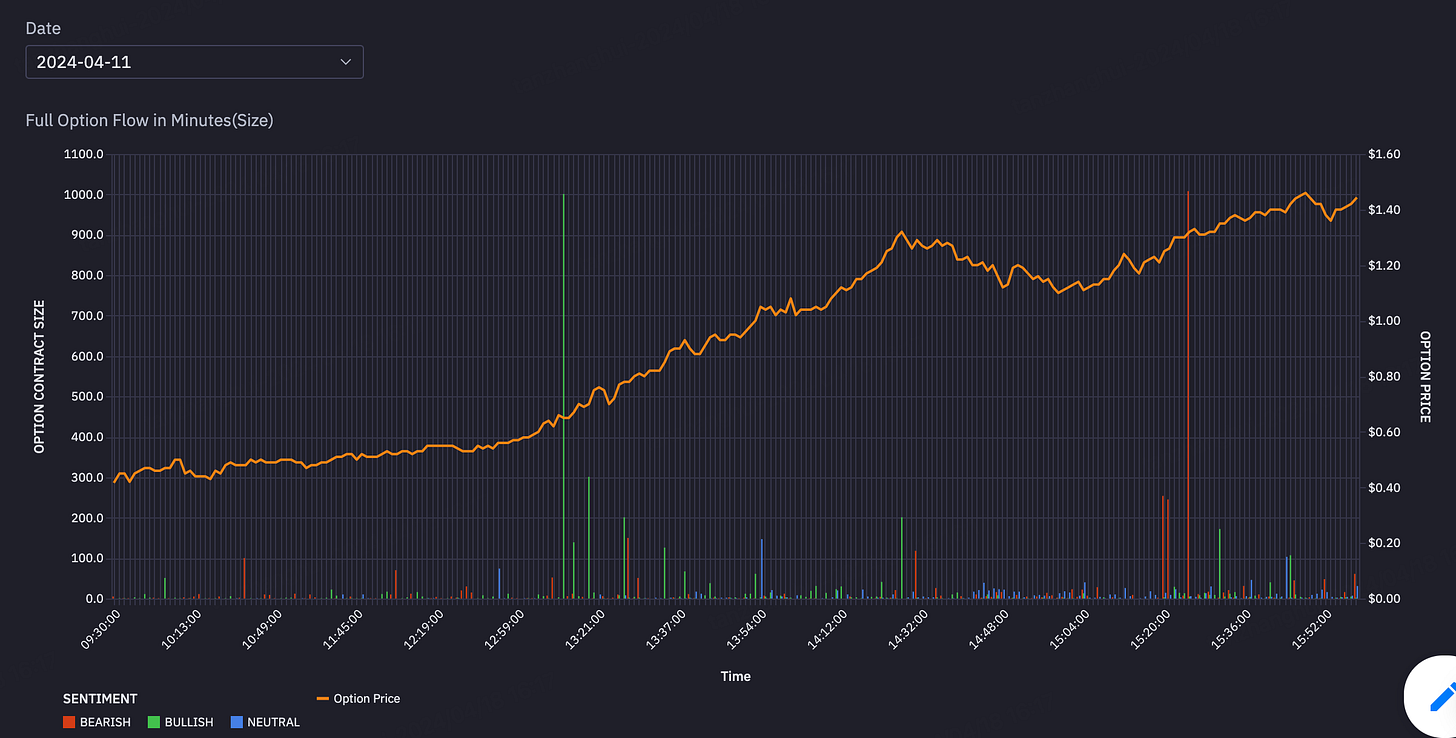

As shown in the chart below, as of approximately 2:32 p.m. on 11th April, the total number of buy orders reached around 2200 contracts, pushing the cost of this series of buy orders to approximately $0.74. All of these transactions resulted in immediate profits upon purchase. After around 3:20 p.m., there were consecutive transactions executed on the bid side, totaling approximately 1500 contracts of call options being sold, with an average execution price of around $1.30.

Based on the open interest (OI) change data obtained on 12th April for the trading day of 11th April (see the chart below), it can be observed that the OI increased by 1689 contracts. However, with the support of the unusually high volume of ask and bid side transactions mentioned above, the total volume of trades for this option contract on the 11th April exceeded 7000 contracts. This suggests that not all trades on that day were new positions being opened; there was a higher likelihood of intraday trading activity. The transactions executed on the bid side were likely profit-taking exits by traders who had bought the call options two hours earlier.

By comparing the selling price of approximately $1.30 with the buying price of approximately $0.74, the trader achieved an intraday profit rate of over 70%, making it a highly successful intraday momentum trade.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now. Promotion 30% off with promo code: 30PCTOFF ends July 15th, 2024.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe