Google Falling Behind in the AI Race, Any Money-Making Opportunities Left?

This is the TradingFlow Team, and this article will focus on options or equities, guiding you through the rationale behind compelling trades and demonstrating how to effectively utilize TradingFlow tools.

In this article, we will use examples of Google options trading to see how to profit from directional swings in the market.

Since the emergence of ChatGPT, we've witnessed a surge in stock prices for tech giants like Nvidia, Meta, and others in this AI wave. However, Google, which also established its AI presence early on, has seen lackluster stock performance.

Amidst such price movements, are there still opportunities for profit?

Recently, options traders seized the upward swings in Google's stock price, profiting from bullish option plays.

First, let's take a look at Google's recent stock trends. Looking at Google's daily chart (we'll use Google's Class A shares $GOOGL as our reference), we can see that Google's A shares rebounded after dropping to around $130 earlier this month.

(Source: TradingView)

Last week's upward gap occurred after reports of Apple negotiating with Google for AI features on the iPhone. The news of these discussions boosted market sentiment for Google, causing the stock price to briefly approach previous highs during the trading session

Long Trade on 7th March

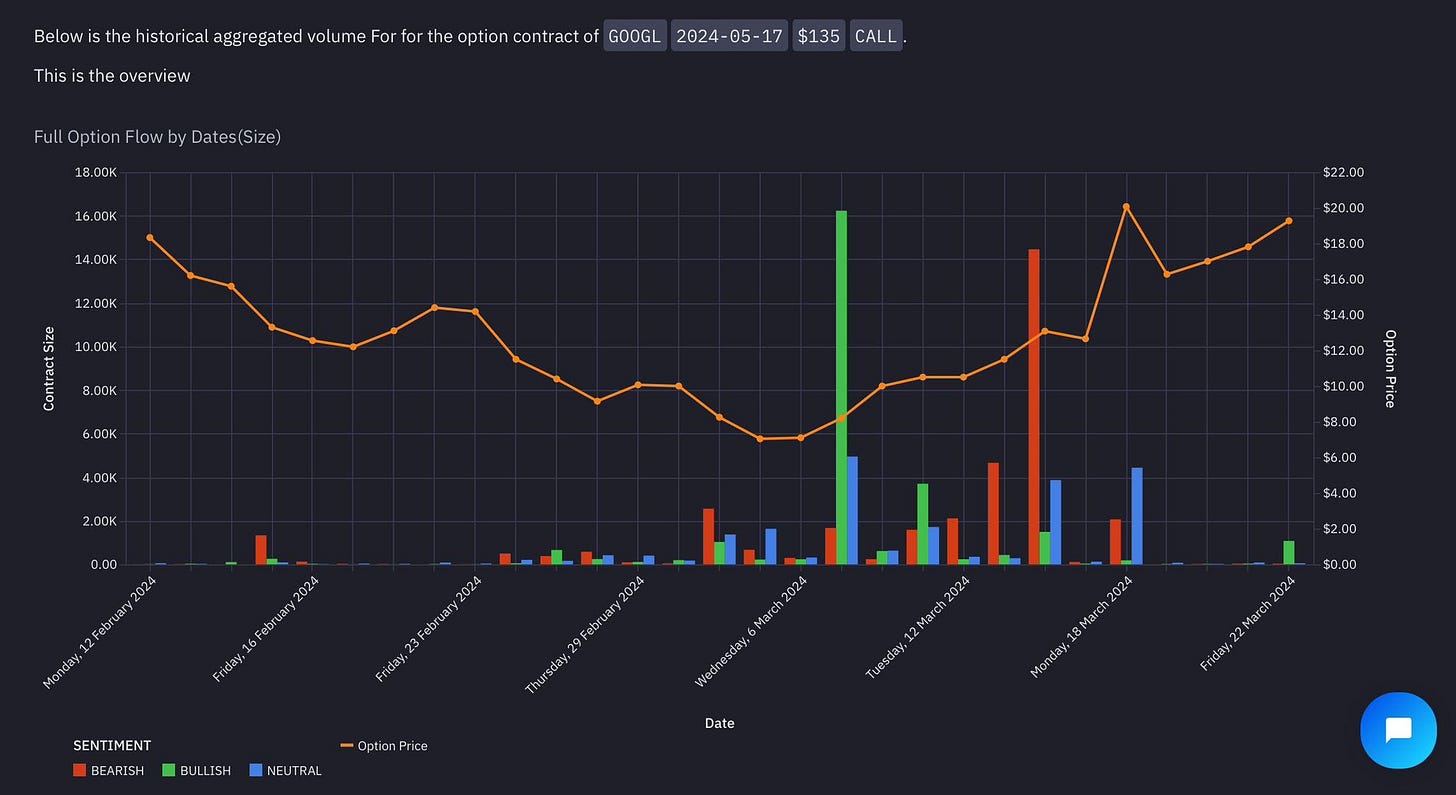

On 5th March and 6th March, after Google's stock price hit a new low for the year, there was a continuous inflow of funds for long positions. During trading on March 7th, a large number of bullish options with a strike price of $135 and an expiration date of 17th May were bought:

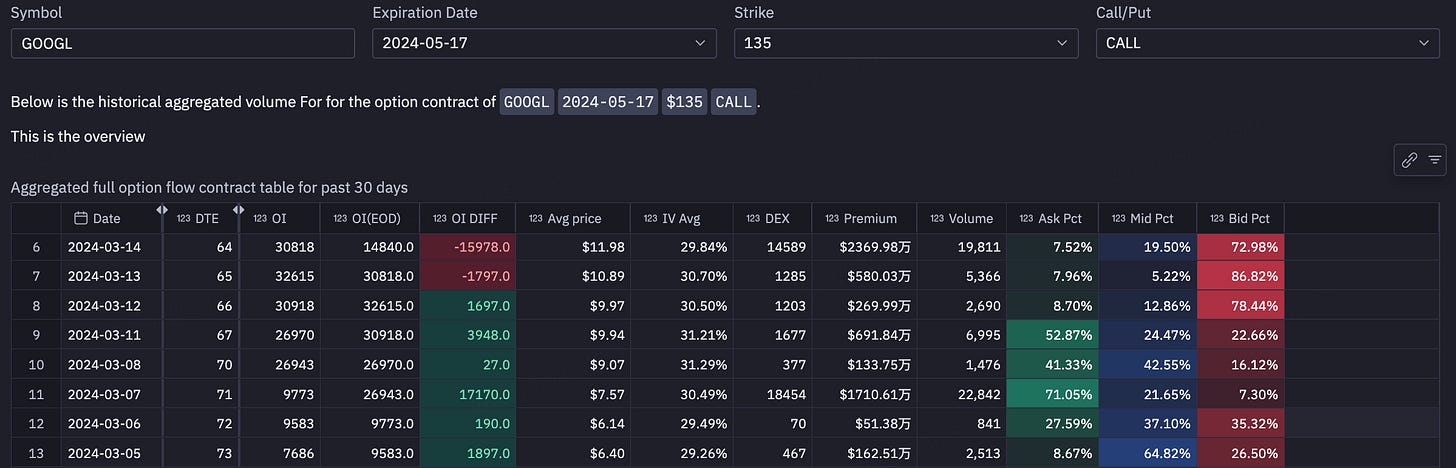

Looking at the contract open interest (OI) (see chart below), there was a significant increase in positions on March 7th. By the end of the trading day, over 17k contracts turned into open interest. Judging from the OI DIFF indicator, it's likely that traders who opened new positions are holding contracts and potentially profiting significantly after 14th March.

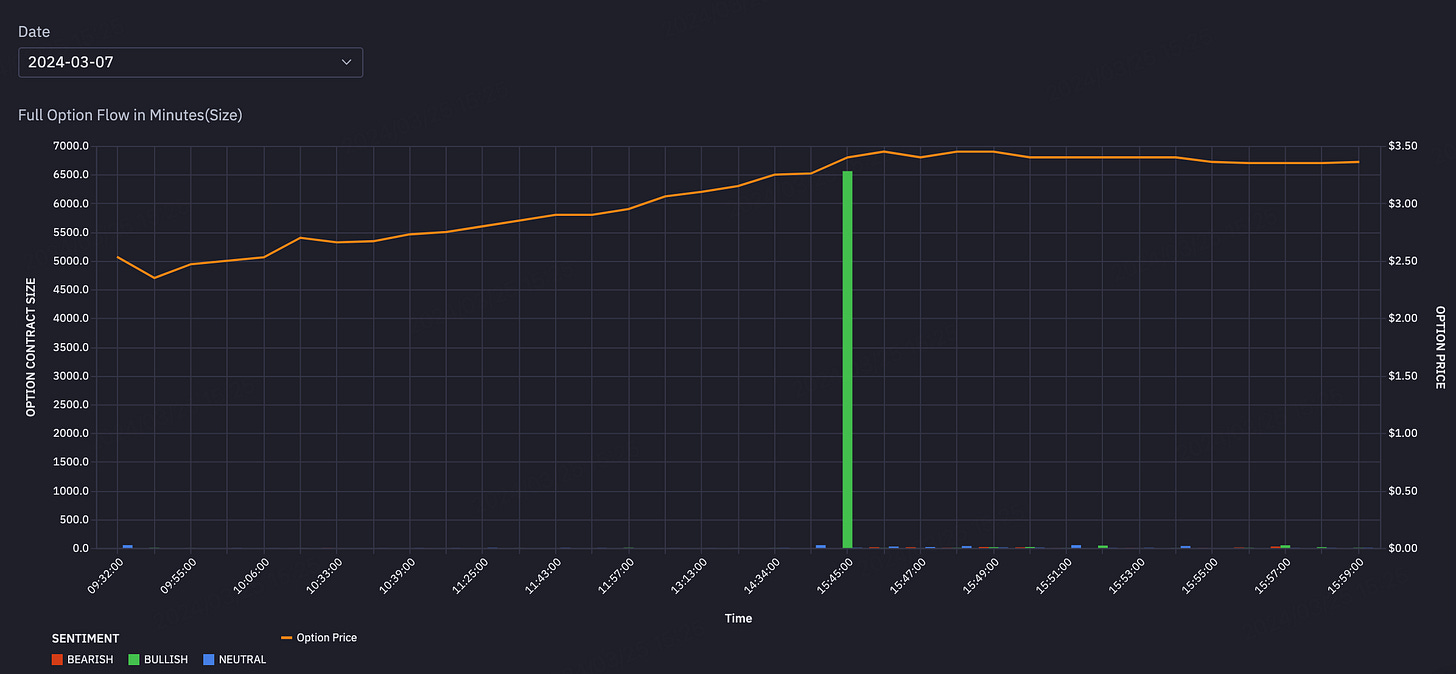

Also on 7th March, there was activity in the options contracts for 19th July with a strike price of $155. The trading volume for contracts with a Bullish sentiment far exceeded the average:

On 7th March, traders transacted at an average price of around $3.28. Subsequently, the contract price peaked on 18th March with an average of approximately $8.98. However, based on the OI data, it appears that traders holding the contracts did not take action and continued to keep their positions open.

Long Trade on 11th March

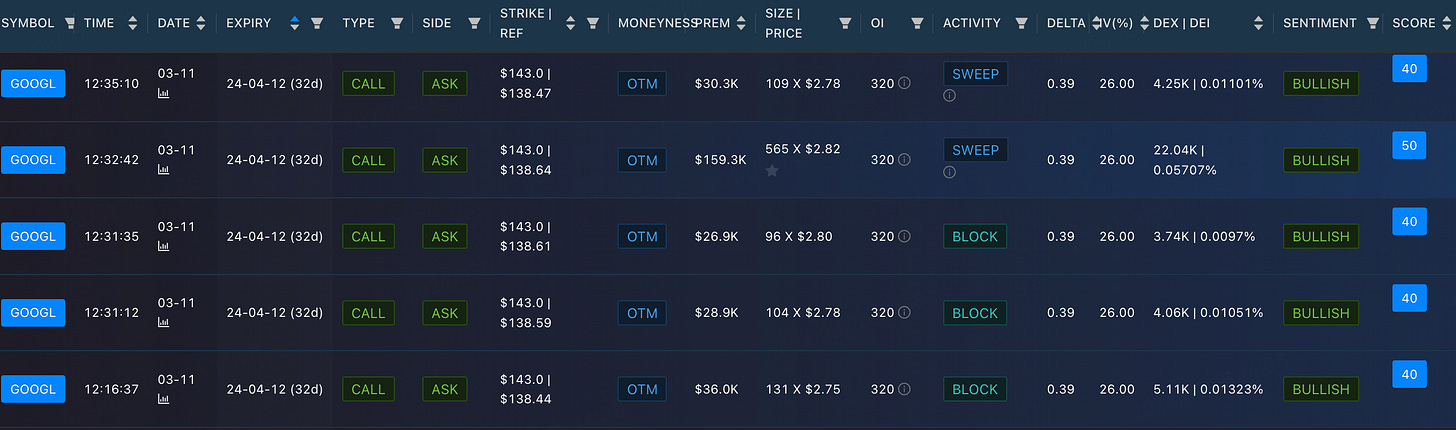

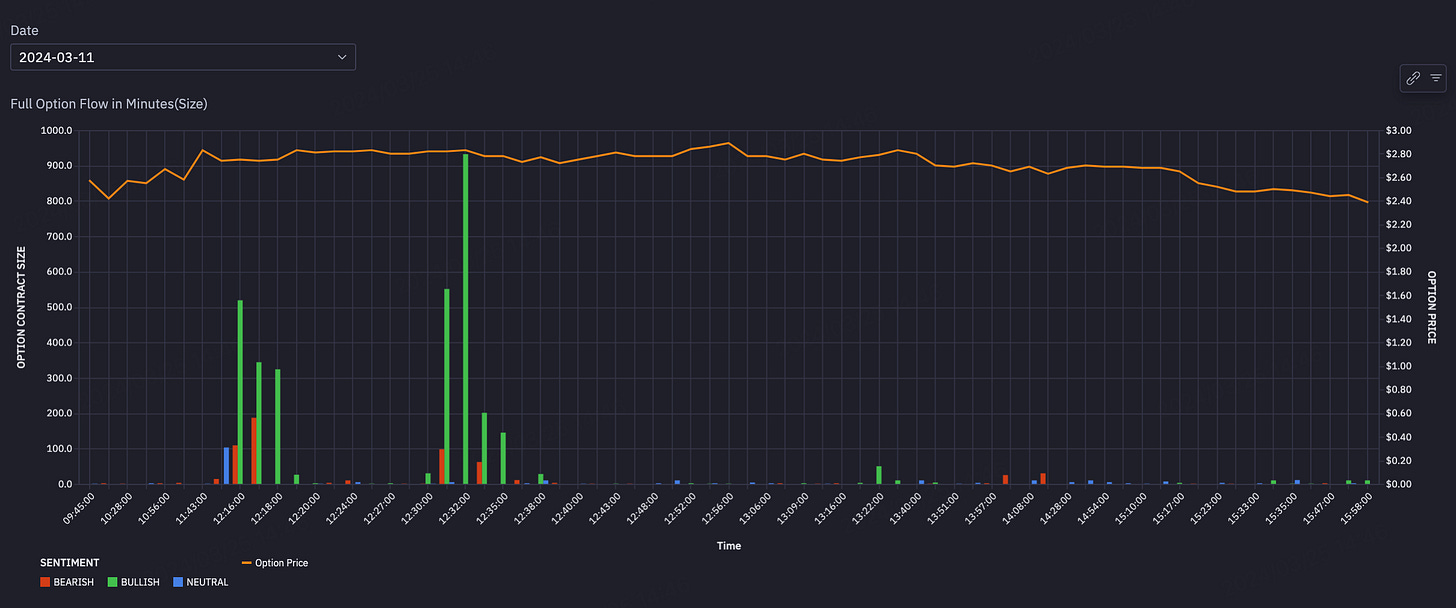

After 7th March, activity in long positions persisted. On 11th March, there was a frenzy of buying for 12th April call options with a strike price of $143. The unusually high trading volume caught the attention of TradingFlow team:

The trade at 12:32:42 (see above), as seen from the volume exceeding the open interest (OI), is likely a new opening position. The intraday chart (see below) provides a clearer picture, showing significant inflows into call options around 12:16 and 12:32.

Looking at the overall data on 11th March (see chart below), there was a significant increase in open interest (OI) for the 12th April call options with a strike price of $143. Buy orders accounted for 80% of the total. Based on the OI analysis, it's likely that the trader exited some of their positions on 18th March, with an average contract price of $9.09, achieving over 200% return compared to average price on 11th March.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now. Promotion 30% off with promo code: 30PCTOFF ends July 15th, 2024.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

As one of the most cost-effective investment platforms currently on the market, moomoo is definitely a go-for for those who would like to fund their option trading. Moomoo not only provides $0 commission fees and $0 US stock option contract fees. Index options are subject to a $0.5 contract fee per contract. Other fees may apply. Until March 31(th), new users have chance to earn up to 8.1% APY on idle cash and 15 free stocks. By enrolling in the Cash Sweep Program, you can enjoy 5.1% basic APY and an extra 3% APY for 3 months once the Rate Booster coupon is activated. With no additional subscription fees required, moomoo provides free real-time options quotes, no longer delayed by 15 minutes. Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus!

Disclaimer: The full article is for information sharing only and does not provide any investment advice. Please be careful with the information provided in the article. The data interpretation in the article may be biased or deficient, so please make your own independent analysis and judgment. If you have any questions about the content of the article, please contact the support team. Options trading is risky and not appropriate for everyone. Read the Options Disclosure Document (j.us.moomoo.com/00xBBz) before trading. Options are complex and you may quickly lose the entire investment. Supporting docs for any claims will be furnished upon request. $0 commission trading is available only to U.S. residents trading in the U.S. markets through Moomoo Financial Inc. Other fees may apply. For more information, visit moomoo.com/us/pricing The Cash Sweep Program is a feature of the brokerage account and should not be viewed as a long-term investment or savings option. The APY might change at any time. Neither Moomoo Financial Inc. nor any of its affiliates are banks. Enrollment in the Cash Sweep Program is required to earn interest on uninvested cash. Promo 8.1% APY (as of 01/11/24): Base Rate is 5.1% APY, plus a 3% temporary boost is available for 3 months on up to $20K in the Program once coupon is activated. Actual APY earned may differ as the base rate may change. The Deposit Welcome Bonus is only available to clients who have never made a deposit. The free stocks received will vary. After receiving the free stocks, you will need to maintain your average assets based on the deposit requirements for 60 days to unlock the stocks. Other terms and conditions apply. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided by the influencer are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any trading strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results.