Bitcoin v.s. Tech Stock: Correlation, Market Sentiment, Recent Trends and More

(Source: Unsplash)

Exploring the Correlation Between Tech Stocks and Bitcoin

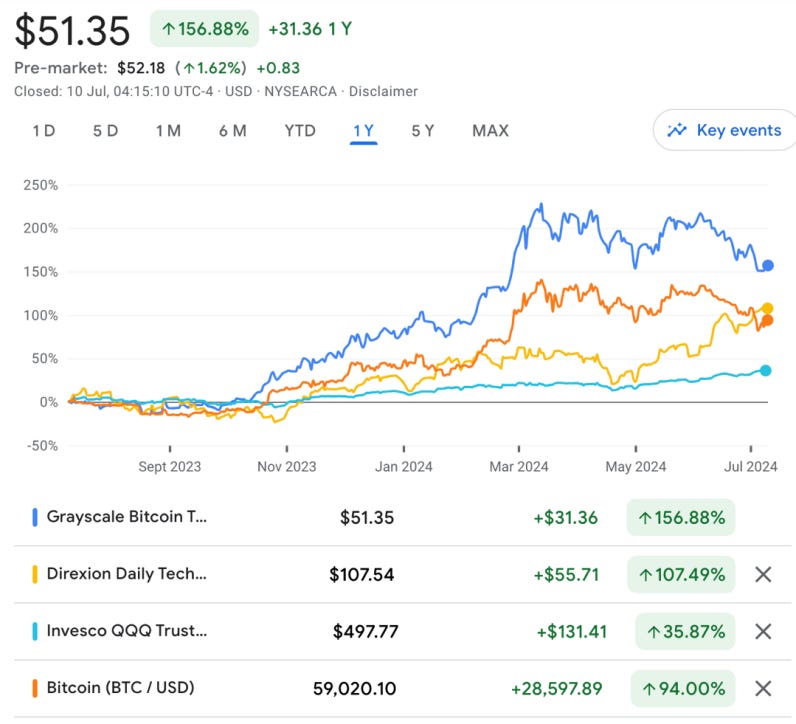

The advent of Bitcoin heralds significant technological innovations and the rise of decentralized blockchain networks. It's intriguing to explore the correlation between the performance of tech stocks and shifts in the Bitcoin market. Often referred to as "digital gold" due to its limited supply and store of value, Bitcoin has experienced notable market movements, especially with the emergence of Grayscale and iShares Bitcoin ETFs. Starting in November 2023, Bitcoin's price surged, reaching a peak of over $73,000 in March 2024.

Invesco QQQ Trust (QQQ):

Overview: QQQ is an ETF that tracks the Nasdaq-100 Index, encompassing 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This ETF provides exposure to major technology and growth-oriented companies such as Apple, Microsoft, Amazon, and Google.

Direxion Daily Technology Bull 3X Shares (TECL):

Overview: TECL is a leveraged ETF designed to provide three times the daily performance of the Technology Select Sector Index. It uses financial derivatives to amplify returns, making it suitable for short-term trading rather than long-term investment.

Grayscale Bitcoin Trust (GBTC):

Overview: GBTC is an investment trust providing exposure to Bitcoin's price movements without requiring direct purchase and storage of the cryptocurrency. It holds Bitcoin, reflecting its value and making it accessible through traditional brokerage accounts.

Market Sentiment and Correlation

Both tech stocks and Bitcoin often respond to overall market sentiment and risk appetite. During periods of high investor confidence, both asset classes tend to perform well as investors seek higher returns from growth-oriented and speculative assets. Conversely, during market downturns or periods of heightened risk aversion, both tech stocks and Bitcoin can experience significant declines as investors move towards safer assets.

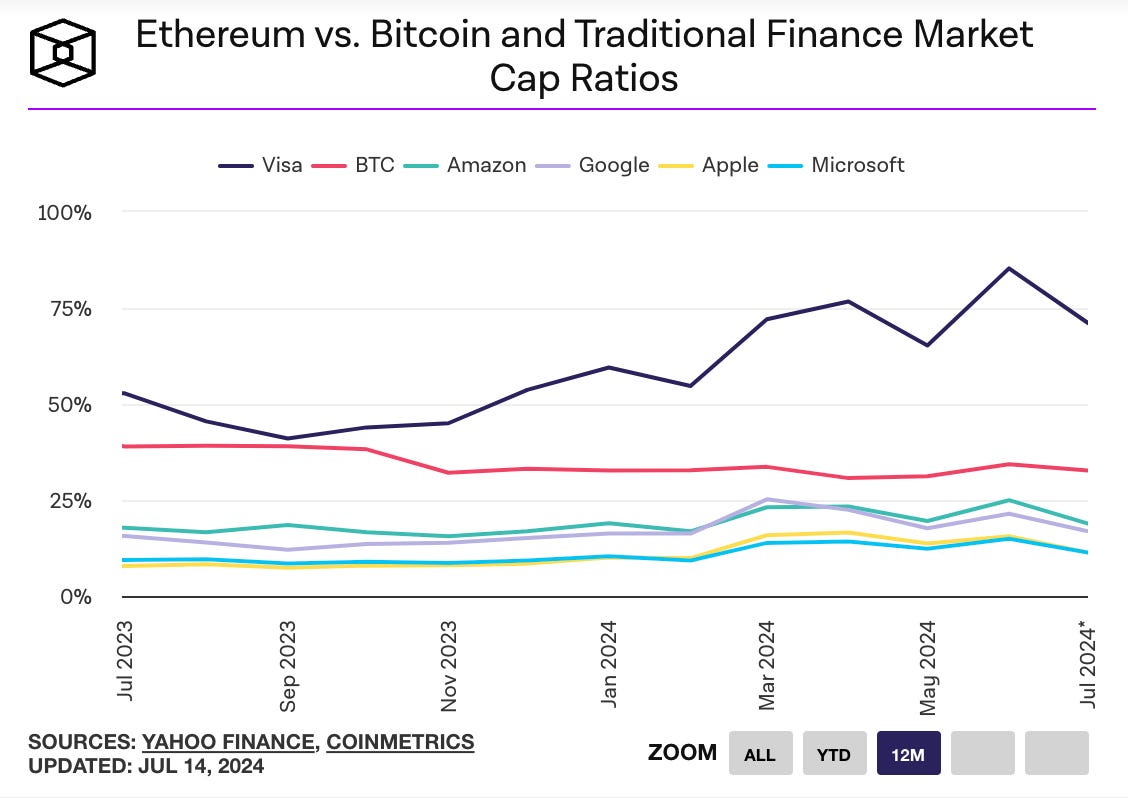

Advances in blockchain technology, increased use of digital currencies, and the growth of tech companies contribute to their performance. Macroeconomic factors such as interest rates, inflation, and monetary policy can influence both tech stocks and Bitcoin. For instance, low interest rates and expansive monetary policies can drive investment into high-growth and speculative assets, benefiting both tech stocks and Bitcoin. Conversely, expectations of rising interest rates or tightening monetary policy can negatively impact both asset classes as investors reassess risk and return profiles.

Recent Performance and Trends

From the graph above, it is evident that Bitcoin and GBTC sometimes move in tandem with TECL and QQQ, while at other times, their movements diverge due to various factors discussed. Starting from November 2023, Bitcoin began to rise in September, while QQQ and TECL started their upward trend later. All four assets were in an increasing trend until December 28, 2023, when TECL and QQQ experienced a pullback, leading Bitcoin to a congestion area until February 10, 2024. At this point, Bitcoin’s annual return of 56.95% aligned with TECL’s annual return of 57.92%. Bitcoin began its rapid growth, reaching its historical peak at 73096.85 usdt on March 13th 2024. The 90-day correlation coefficient of the digital currency and the tech-heavy Nasdaq 100 index reached 0.46 in mid May.

From February 10 to July 3, TECL and Bitcoin appeared to have a negative correlation. However, the minor trends within each day and their amplitude were still largely correlated, influenced by market expectations regarding Powell’s speeches, interest rate adjustments, and technological developments.

Recent Market Events

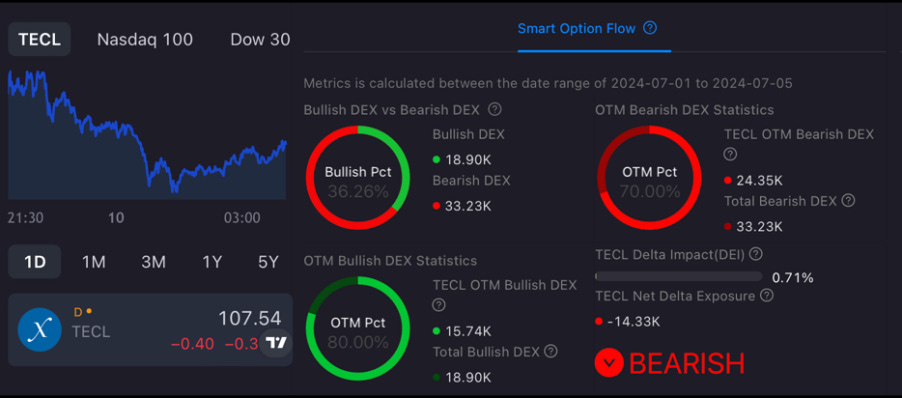

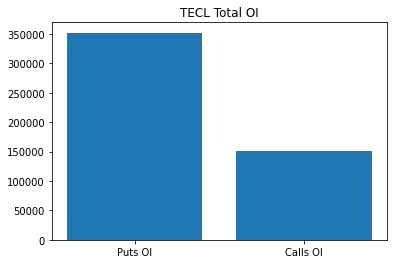

In the past week, from July 3 to July 10, Bitcoin's price dropped to $53,485.93 over two consecutive days, creating market fear and leading the Fear and Greed Index to zero. This was influenced by events such as Mt.Gox’s compensation of 142,000 Bitcoins to past cryptocurrency holders and the German government’s sell-offs. In contrast, TECL showed bearish signs with a net delta exposure of -14.33k from July 1 to July 5, despite a bullish market sentiment indicated by higher call open interest compared to puts.

On July 9, the total open interest of calls was 352,039, and the total open interest of puts was 151,623, suggesting a bullish sentiment for TECL. On the same day, Bitcoin increased from $57,247 to $59,470. While long-term prospects for both Bitcoin and tech stocks remain bullish, particularly with potential decreases in interest rates, short-term breakouts may not be imminent.

Conclusion

Understanding the performance and characteristics of QQQ, TECL, BTC, and GBTC provides a foundation for analyzing their correlation. While each asset has unique drivers, their performance often aligns due to shared market sentiment, innovation trends, liquidity conditions, and macroeconomic influences. Investors can use this correlation to inform their portfolio strategies, balancing risk and return across different asset classes.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now.

In addition, we also offer TradingFlow self-service analysis platform. If you are interested in learning more or trying it out, please apply through this link.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe