Analyzing Unusual Options Flow in Chinese Concept Stocks and Its Role in Driving the Stock Market Rally

This is the TradingFlow Team, and in this article, we will track the recent surge in Chinese concept stocks, focusing on the options activity fueling this frenzy. Before diving in, please note that we've previously published an in-depth analysis on the Chinese stock rally.

If you missed it, please refer to: The Rebound of Chinese Concept Stocks: Key Insights from the Options Market.

As the market fluctuates, we’ve observed some unusual activity in the options market including three Chinese concept stocks: Tiger Brokers (TIGR), Alibaba (BABA), and Pinduoduo (PDD). Hope this article could help you to identify and interpret key information within the options data, providing valuable insights for decision-making.

On 30th September, an unusual movement was observed in the $TIGR call options contract with a strike price of $6 and an expiration date of 17th January, 2025. About one hour after the market opened, a surge in buy orders pushed the contract volume close to 9,000. According to TradingFlow data, the trader executed the order near the day's high at approximately $1.03, bringing the total cost of the options premium to nearly $900,000.

Later, as $TIGR's stock price weakened by midday, the price of the $6 strike options contract, expiring on 17th January, 2025, also dropped, hitting a low of $0.75, marking a decline of over 27% from the trader's entry price. However, by the end of the trading day, no further large transactions were recorded for this contract.

Data updated on 1st October shows that the Open Interest (OI) on 30th September increased by 11,058, confirming that the large transaction mentioned above was most likely a new position, and it remains open.

In the following trading days, the price of $TIGR continued to surge. Based on the Open Interest (OI) value of the aforementioned contract, it is highly likely that the trader who opened the position on 30th September is still holding it. As of the updated average price on 4th October, this trade may have yielded a profit of over 460%.

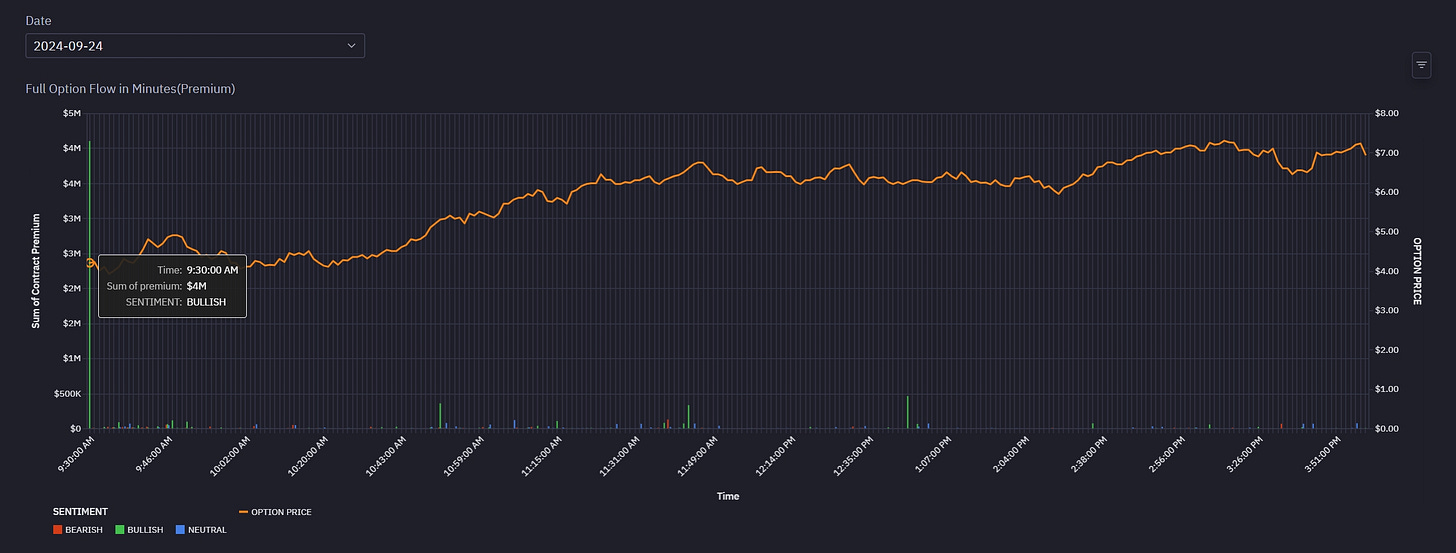

The unusual options activity for Pinduoduo appeared on 24th September, with the $PDD call options contract expiring on 15th November, 2024, and a strike price of $115. A large volume of contracts was executed at the ask price of approximately $4.15.

Similarly, based on the change in Open Interest (OI), this trade was a new position opened on 24th September. As of the most recent trading day (4th October), there is no data indicating that the trader has closed the position. Calculating from the change in the average contract price, this position has already gained 600%.

During the early session on 1st October, two large buy orders for the $BABA call options contract, expiring on 11th October, 2024, with a strike price of $116, flooded the market. The total trading volume was approximately 7,500 contracts, with an average execution price of about $2.01.

Still considering the change and absolute value of Open Interest (OI), it appears that the trader executing this operation continues to hold the position and has not closed it. Based on the average contract price on 4th October and the trader's entry cost, the profit margin has reached 70%.

If you like this article, please subscribe. To use all the tools, start a free trial for 14 days now.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Before making any financial investment decisions, please ensure you thoroughly understand all aspects of the information and conduct your own research.

🎁 Bonus time 🎁 with Moomoo, one of the most cost-effective investment platforms currently on the market!

Click the link below to try moomoo and receive your welcome free stock and cash sweep bonus! 👉: https://j.moomoo.com/00IRhe

does tradingflow alert subscribers on these potential plays? or do you simply provide the platform for subscribers to find their own trades?